Bond duration formula

One year back the company had raised 50000 by issuing 50000 bonds worth 1000 each. Example of Effective Duration.

Partial Pressures Of Gases And Mole Fractions Chemistry Tutorial Mole Fraction Chemistry Fractions

The price of the bond increases to 103 when the yield falls by 025.

. Understand the Macaulay duration formula. Next determine the rate at which coupon payments will be paid and using that calculate the periodic coupon payments. The Macaulay duration for coupon-paying bonds is always lower than the bonds time to maturity.

If the YTM for the bond is 5 then calculate the bonds modified duration for the following annual coupon rate. V 0 The present value of cash flows ie. Initially determine the par value of the bond and it is denoted by F.

An investor buys a bond at par for 100 with a yield of 8. The formula to calculate interest earned is principal amount multiplied by interest rate multiplied by time period. Its the percentage change of a bonds price based on a one percentage point move in market interest rates.

Present Value PV is the value at time0 Future Value FV is the value at timen. So the price at a 1 increase in yield as predicted by Modified duration is 86954 and as predicted using modified duration Modified. It is the product of the par value of the bond and coupon rate.

Essentially it divides the present value of the payments provided by a bond coupon payments and the par value by. In finance the duration of a financial asset that consists of fixed cash flows such as a bond is the weighted average of the times until those fixed cash flows are received. Here we discuss to calculate Modified Duration with examples.

The Macaulay duration is measured in units of time eg years. Modified duration follows the concept that interest rates. T i Time in years associated with each coupon payment.

So the price would decrease by only 4064 instead of 4183. Moving down the spreadsheet enter the par value of your bond in cell B1. It returns a clean price and dirty price market price.

Imagine that you have a bond where the. It is calculated by dividing the sum product of discounted future cash inflow of the bond and a corresponding number of years by a sum of the discounted future cash inflow. In organic chemistry when a molecule with a planar ring obeys Hückels rule where the number of π electrons fit the formula 4n 2 where n is an integer it attains extra stability and symmetry.

We also provide Modified Duration Formula calculator. You can easily calculate the bond duration using the Bond Duration Calculator. Modified duration is a formula that expresses the measurable change in the value of a security in response to a change in interest rates.

A covalent bond is a chemical bond that involves the sharing of electrons to form electron pairs between atoms. The formula for the calculation of Macaulay duration is expressed in the following way. This shows how for the same 1 increase in yield the predicted price decrease changes if the only duration is used as against when the convexity of the price yield curve is also adjusted.

PV Bond price. The modified duration of a bond is a measure of the sensitivity of a bonds market price to a change in interest rates. This page contains a bond pricing calculator which tells you what a bond should trade at based upon the par value of the bond and current yields available in the market sometimes known as a yield to price calculator.

The bonds price Δy The change in the value of the yield. Merced County plans to create a new park in the Franklin-Beachwood area and an update will be provided to the community this week. The main advantage is that the investor needs to know the duration of the bond Duration Of The Bond The duration formula measures a bonds sensitivity to changes in the interest rate.

In cell A3 enter the formula A1A2 to yield the total annual coupon payment. Calculate cash flow as. MPT is a standard.

FV Bond face value. Let us take the example of some coupon paying bonds issued by DAC Ltd. Macaulay duration is the most common method for calculating bond duration.

The formula used to calculate the modified duration of a bond is as below. The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. Modified duration Macaulay duration 1 Yield To Maturity of the bond The results obtained from this model are in the form of a percentage.

Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Similarly calculated as below. The annual interest for the IBM bond is 10000 X 6 X 1 year 600.

Therefore each bond will be priced at 83879 and said to be traded at a discount bond price lower than par value because the coupon rate Coupon Rate The coupon rate is the ROI rate of interest paid on the bonds face value by the bonds issuers. If all of the interest was paid at maturity the first years interest of 600 would not be paid until the end of 10 years. Formulas to Calculate the Bond Duration.

Finally the formula for the bond price can be used to determine the YTM of the bond by using the expected cash flows step 1 number of years until maturity step 2 and bond price step 3 as shown below. It sums the present value of the bonds future cash flows to provide price. Duration is expressed as a number of years.

Guide to Modified Duration Formula. Risk measures are statistical measures that are historical predictors of investment risk and volatility and they are also major components in modern portfolio theory MPT. It determines the repayment amount made by GIS guaranteed income security.

Coupon Bond Formula Example 1. Read on about Franklin-Beachwood Park. The weight of each cash flow is determined by dividing the present value of the.

When the price of an asset is considered as a function of yield duration also measures the price sensitivity to yield the rate of change of price with respect to yield or the percentage change in price for a parallel. Once you are done entering the values click on the Calculate Bond Duration button and youll get the Macaulay Duration of 1912 and the Modified Duration of 1839. Once you calculated the Macaulay duration you can then apply the following formula to get the Modified Duration ModD.

V Δy The bonds value if the yield rises by a certain percentage. MacD ModD 1YTMm Example of calculating the bond duration. Bond Price Cash flow t 1YTM t The formula for a bonds current yield can be derived by using the following steps.

What is the Modified Duration. It is denoted by C and mathematically represented as shown below. For this bond the Macaulay duration is 2856 years heavily weighted towards maturity 3 years.

Simply enter the following values in the calculator. The present value PV formula has four variables each of which can be solved for. For zero-coupon bonds the duration equals the time to maturity.

C Coupon rate. So a 15-year bond with a duration of 7 years would fall approximately 7 in value if the interest rate increased by 1 per annum. In other words duration is the elasticity.

Enter 4 for a bond that pays quarterly.

Gordon Growth Model Valuing Stocks Based On Constant Dividend Growth Rate Dividend Power Dividend Dividend Investing Value Investing

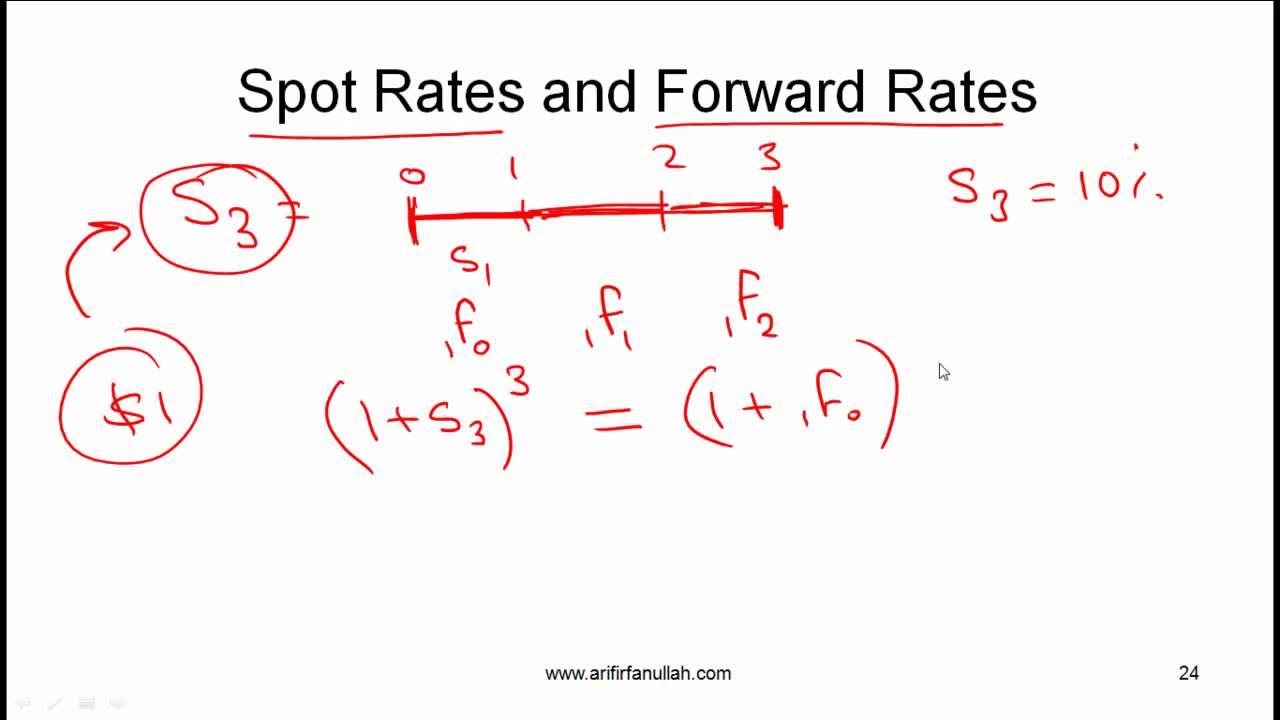

Cfa Level I Yield Measures Spot And Forward Rates Video Lecture By Mr Arif Irfanullah Part 5 Youtube Lecture Mr Video

Compound Interest Organic Chemistry Study Chemistry Basics Chemistry Lessons

Seo2 Molecular Geometry Shape And Bond Angles Selenium Dioxide Molecular Geometry Molecular Molecules

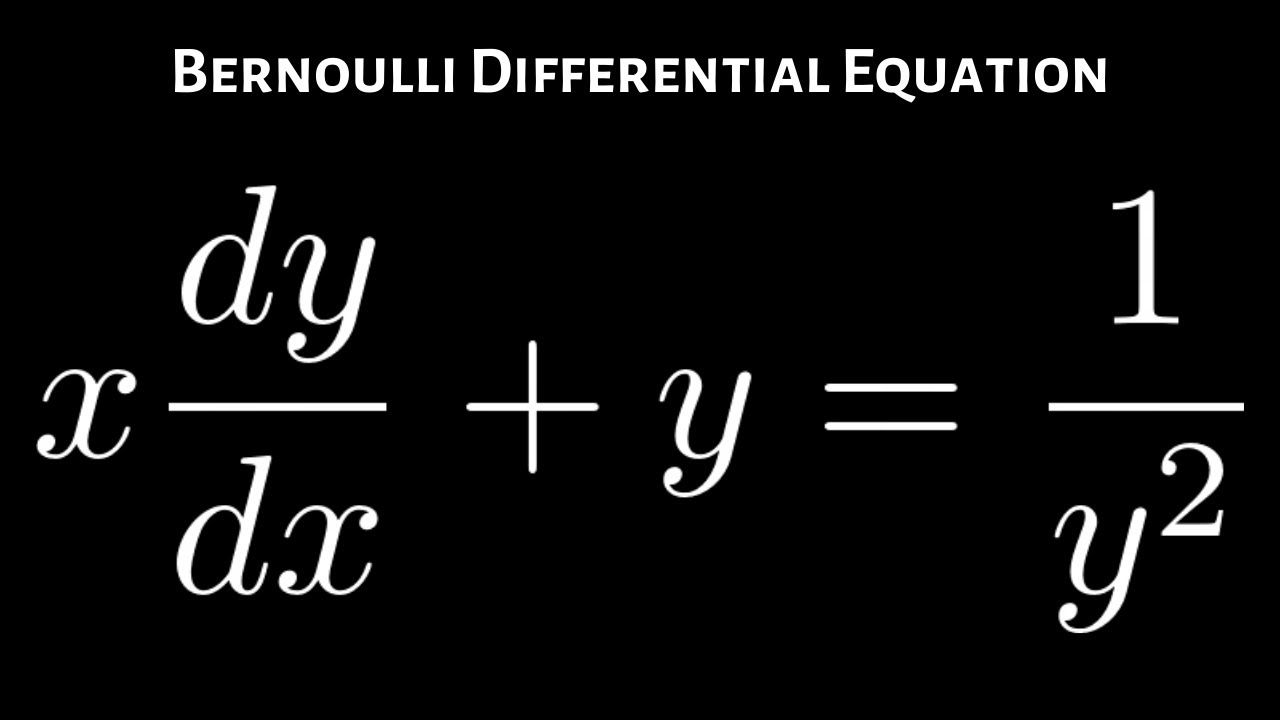

Bernoulli Differential Equation X Dy Dx Y 1 Y 2 Differential Equations Math Videos Math Lessons

Covalent Bond Covalent Bonding Chemical Bond Water Molecule

Pin On Structure And Bonding In Organic Chemistry

How To Calculate The Yield Of A Zero Coupon Bond Using Forward Rates Bond Calculator Really Cool Stuff

Acetaldehyde Ethanal Ch3cho Molecular Geometry Hybridization Molecular Weight Molecular Formula Bond Pairs L Molecular Geometry Molecular Geometry

Degrees Of Unsaturation Or Ihd Index Of Hydrogen Deficiency Chemistry Index Organic Chemistry

Ammonium Chloride Nh Cl Molecular Geometry Hybridization Molecular Weight Molecular Formula Bond Pairs Lon In 2022 Molecular Geometry Molecular Infographic

Quantum Mechanics 12c Dirac Equation Iii Quantum Mechanics Dirac Equation Quantum

Steric Number And Bond Angles Teaching Chemistry Molecular Geometry Chemistry

Here Is What I Ve Been Compiling As The Hardest To Learn Formulas For The Memorization Phase Not Surprising How To Memorize Things Formula Forensic Accounting

Must Know Cfa Formulas Business Insider Fisher College Of Business Business Insider Formula

Bond Price Calculator Online Financial Calculator To Calculate Pricing Valuation Of Bond Based Financial Calculator Financial Calculators Price Calculator

What Is A Product In Chemistry Definition And Examples Chemistry Definition Chemistry What Is A Product